As G&C Mutual Bank marks its 65th anniversary in 2024, it’s an opportunity to reflect on a remarkable journey of growth, resilience, and unwavering commitment to members.

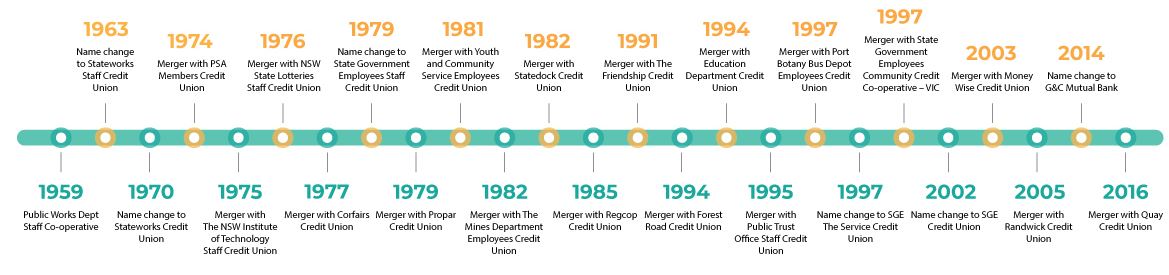

Established in 1959 as the Public Works Department Staff Cooperative, G&C Mutual Bank Limited has since grown to be one of Australia’s strongest member-owned financial institutions. Numerous mergers, solid growth and consistent performance underpin G&C Mutual Bank’s success.

You’re part of something great

As a member of G&C Mutual Bank, you're part of a movement that began in Australia when groups of like-minded workers and communities came together to create building societies, credit unions and mutual banks.

G&C Mutual Bank was established with the purpose of providing key worker groups with financial services that prioritised members over profit. From the beginning, our guiding principles were embedded in mutuality and community spirit. Our founders envisioned a financial cooperative that would serve members with integrity, transparency, and a personal touch, which set the foundation for an enduring legacy of trust and community-focused banking.

Our growth and evolution

We have always remained true to our proud origins and history, as we continue to evolve and grow through mergers, transformations and the changing financial services landscape.

In late 2014, the change of name from SGE Credit Union to G&C Mutual Bank marked the start of an exciting new era for your bank. G&C Mutual Bank was re-positioned to highlight its customer owned proposition – a different kind of bank, owned by its members and operating solely for their benefit. The brand reinforced the fundamental pillars on which our business has been built over many years – including our commitment to serving the needs of government employees and regional communities, our focus on growth for the benefit of our members, and our continuing efforts to work collaboratively with other mutual financial institutions.

In this spirit, we also look forward to the future and our continued evolution, including our proposed merger with Unity Bank which would see the creation of one of Australia’s largest nationally operating mutual banks. Although G&C Mutual Bank has performed very well in recent years, the enhanced scale delivered once the merger is approved will allow us to accelerate investments in technology, products, fraud prevention and regulatory compliance while continuing to offer members first class service, award-winning products and competitive interest rates.

The merger also provides an exciting opportunity to combine the strengths and proud histories of the two organisations in a “merger-of-equals” which will allow us to offer improved products and services for our combined membership base as a values-based bank.

Conservative lending and member first approach

G&C Mutual Bank’s commitment to maintaining conservative lending standards, our focus on customer segments that are well known and trusted, and our reliance on in-house origination channels rather than mortgage brokers, have together underpinned the Bank’s very low level of loan arrears. We’re proud of our record of 65 years of never incurring a loss on a home loan.

The Banking Royal Commission revealed systemic misconduct by the major banks, while G&C Mutual Bank offered a viable alternative as a bank that puts its members first. Our approach is to be there to help our members in times of need or financial difficulty, just as we always have.

Putting people first and helping our community are central to G&C Mutual Bank’s ethos. We strive to help our members and be there for them when they need us most. We’ve stood by our members though droughts, fires, recessions, and the hardships of COVID-19.

Strength, opportunity and resilience

The financial landscape has seen significant changes over the years, from economic fluctuations to technological advancements. G&C Mutual Bank has adeptly navigated these shifts, adapting its strategies and services to meet evolving member needs. Our resilience and ability to embrace change have been instrumental in our sustained success.

G&C Mutual Bank has continued to achieve strong loan growth in recent years, and continues to be one of the top performing mutual banks, often delivering solid above system loan growth.

G&C Mutual Bank developed a close partnership with MoneyMe (formerly SocietyOne), Australia’s first and most successful “marketplace” lender, under which G&C Mutual Bank funds loans originated via their online platform. It was a great success and helped drive a doubling of G&C Mutual Bank’s Personal Loan portfolio, a portfolio that had previously been on a downward trend for 15 years.

The ability to expand third party origination channels and develop relationships with Plenti, Lannock, and MedPro has further bolstered G&C Mutual Bank’s success year on year.

Growing from strength to strength, G&C Mutual Bank achieved dual external credit ratings from Moody’s and S&P (Standard and Poor’s) which have helped deliver cheaper funding to underpin our suite of loan products.

Award-winning products

As a member owned bank, we strive to deliver exceptional value to our members through high-quality products. To ensure that G&C Mutual Bank’s products remain market competitive, we routinely submit our full range of products for independent assessment and peer benchmarking. Our numerous awards confirm our ongoing commitment to providing products that offer great value for our members.

G&C Mutual Bank is one of the few mutual banks to offer a platinum credit card with the ability to earn frequent flyer points. Our Platinum Visa Credit Card has just been recognised with a 2024 Mozo Experts Choice Award – Qantas Frequent Flyer Credit Card. Our Low Rate Visa Credit Card offers one of the lowest, longest running purchase rates in market and has been awarded year on year for its outstanding value, low rate, competitive features and low fees. This year marks the 10th consecutive year that we have achieved the Mozo Experts Choice Award – Low Rate Credit Card. Our Low Rate Business Credit Card has also been recognised with a 2024 Mozo Experts Choice Award and a 2024 Finder Award.

A number of years ago, we developed our Fair Rate Personal Loan, providing an innovative risk-based pricing model designed to reward our most loyal and creditworthy borrowers with lower interest rates which was recognised with a number of award wins at the time.

In 2017, G&C Mutual Bank re-launched our specially designed and discounted home loan for first home buyers to help them compete in a very challenging market for younger borrowers. Our support for first home buyers continued to grow and we have further refined our First Home Buyer Loan which continues to be an award winner, picking up 2024 Canstar Customer-Owned Bank of the Year - First Home Buyer NSW & VIC. Additionally, G&C Mutual Bank is proud to be a participant lender in the Federal Government’s Home Guarantee Scheme, helping even more Australians realise the dream of home ownership.

Launched in 2020, our Momentum Home Loan was designed to target those looking to refinance their existing home loan from another institution, driving a strong lift in new G&C Mutual Bank members. Since its inception, it has been recognised with a range of industry awards and most recently won six 2024 RateCity Gold Awards and a 2024 Finder Award.

Over the past few years, we have been recognised for offering quality Term Deposits across rates, terms and features with 2024 Canstar Customer-Owned Bank of the Year - Term Deposits and 2024 Mozo Experts Choice Award - Term Deposits and SMSF Term Deposits.

We always aim to strike a balance between the competing needs of our borrowing and depositing members and offer products that deliver both value and quality features.

A journey of innovation

Over the decades, G&C Mutual Bank has embraced innovation to stay at the forefront of the financial industry. The early days saw the introduction of pioneering financial products and services tailored to the needs of our members. With the rapid pace of technological change since the introduction of Online Banking, our members look to new, faster and more convenient ways to transact and G&C Mutual Bank continues to invest in our digital channels.

G&C Mutual Bank was one of the first non-major banks to implement the New Payments Platform (NPP), thereby ensuring that our members would be among the first to benefit from real-time payment services.

In 2019, we invested in upgrading our website to a responsive design, allowing better engagement with mobile users and more accessibility for those using assistive technology. G&C Mutual Bank also became the second Australian bank to implement the ".bank" domain across its website and emails, providing immediate visual trust for our members and helping to mitigate cyber security risk.

Over the past few years, we have continuously implemented significant upgrades to the visual design, functionality and security of our Mobile App, and more recently, our Online Banking services. We enhanced our fraud and cyber-crime protection for members which included One Time Password (OTP) on login, complex passwords and self-service password reset for Online Banking, and card controls for our Mobile App.

Following on from the introduction of digital wallet technology (Apple Pay, Google Pay and Samsung Pay), G&C Mutual Bank has recently launched digital card issuance. This allows members to receive a digital card via our Mobile App and start using it without the need to wait for a physical card or PIN to arrive in the mail.

We have also just implemented International Osko payments, and PayTo - a fast and secure way to manage payments and subscriptions directly from Online Banking.

G&C Mutual Bank aims to enable members to conduct their banking activities whenever and wherever they choose, backed by reliable and secure technology, innovative products and personalised staff support.

Mutually valuable banking for people and planet

As a mutual bank, we’re always striving to make a positive impact and we are committed to a more sustainable future for our members and their communities. We recognise the importance of sound practices as part of our responsibility to members, employees and the communities in which G&C Mutual Bank is a part of. Through our Environmental, Social and Governance (ESG) Strategy, G&C Mutual Bank aims to provide quality, competitive products in a secure, accessible and ethical manner, while assessing and improving the impact we have on our environment and society.

In 2021, we announced that G&C Mutual Bank had become an Associate Member of the Global Alliance for Banking on Values (GABV), one of only four Australian banks in this network. The GABV promotes a positive, viable banking model that’s focused on meeting human needs and sustainability. By joining the GABV, G&C Mutual Bank can reinforce its mission to provide its members and communities with highly valued products and services in a manner that is financially sustainable.

In late 2022, G&C Mutual Bank became the first financial institution globally to be accredited under the Mutual Value Measurement (MVM) Accreditation process. The MVM Framework was developed by the Business Council of Co-operatives and Mutuals (BCCM) and researchers at Monash University’s Business School to help mutual organisations measure their total value creation (mutual value) through a set of common dimensions and shared language about measuring and reporting mutual value.

In 2023, G&C Mutual Bank introduced more environmentally conscious options across our debit and credit cards as part of our commitment to a more sustainable future. These cards are Australian made from 82% recycled PVC and accompanied by card carriers and PIN mailers made of 100% recycled paper and packaged in 100% biodegradable envelopes.

Additionally, we developed our Responsible Banking Policy guiding our approach to lending and investing with respect to our ESG Strategy. We also implemented a range of service enhancements to provide accessible and inclusive banking for members.

We launched our Essential Worker Home Loan, our first social impact product which was designed to recognise the contribution essential workers make to the community by supporting their home ownership journey. This product builds on our proud history of working with key worker groups and our long standing relationships with NSW Ambulance and Corrective Services, but has also been a large source of new-to-bank members aligned to this cohort.

In 2024, G&C Mutual Bank was part of the respect and protect initiative designed to disrupt the rise of financial abuse in Australia. We also updated our terms and conditions to include a gambling merchant block on credit cards, and incorporate additional information regarding financial hardship and abuse. We have added new member education content including financial hardship, our Elder Financial Abuse Guide and Online Banking Guides, to help support vulnerable members.

These are some of the ways we are working as a mutual bank to build a better future for all, and we aim to continue improving our contribution to positive social and environmental change.

Celebrating our members and staff

The success and longevity of G&C Mutual Bank are a testament to the loyalty and support of our members, as well as the dedication of our staff. We love hearing from our members on how we are living our values and exceeding expectations, or recognising where we can do better to drive continuous improvement and enhance the service we offer.

Our achievements are the result of a collective effort, driven by a shared vision of providing exceptional service and fostering a strong sense of community. As we celebrate our 65 years, we also celebrate all those who have been a part of our story and say, thank you.

Since 1959, we have helped generations of Australians realise their financial goals. We're committed to helping our members buy homes, build thriving businesses and grow communities. We look forward to the future with optimism, confident that G&C Mutual Bank will continue to thrive and make a positive impact for many years to come. We’re excited to build on our strong history and create a brighter future, together.